Managing business expenses has always been one of the most challenging aspects for organisations, regardless of their size. Keeping track of every transaction, ensuring compliance with policies, and reducing unnecessary costs can feel overwhelming if done manually. This is why businesses today are actively seeking technology-driven solutions that not only simplify processes but also enhance financial transparency.

Interestingly, a recent study revealed that companies can save up to 30% of costs annually by streamlining their travel and expense processes through digital platforms. This significant figure highlights the importance of adopting the right tools that can manage costs while also enabling smarter decision-making across departments. It’s not just about reducing expenditure; it’s also about increasing efficiency at every step.

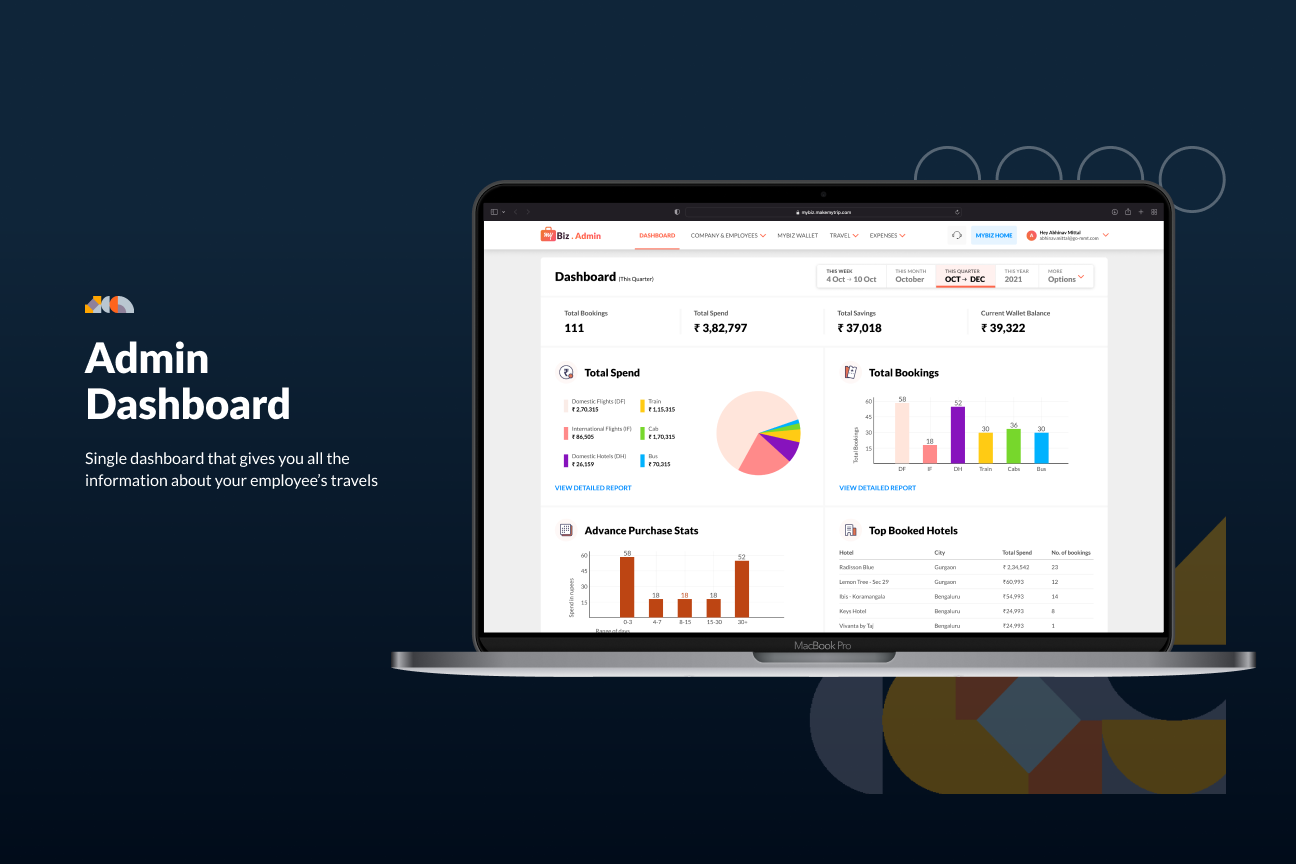

On top of that, platforms like myBiz provide advanced features such as policy mapping and automated dashboards that give managers and finance teams better control and visibility over employee spending.

By integrating these tools, businesses can ensure that policies are followed consistently while offering employees a hassle-free way to manage their bookings and claims. Such benefits prove invaluable for organisations looking to optimise their financial systems.

In this blog, we will explore the importance of using expense management software, understand how it can transform business operations, and look at the different advantages it brings to both employers and employees. We will also discuss how leveraging smart digital solutions ensures businesses can maintain financial discipline while creating a seamless travel and expense experience.

The Importance of Digital Expense Management

Businesses today operate in highly dynamic environments where financial efficiency can determine long-term success. Expense management tools allow organisations to simplify the way they track, approve, and control spending, creating more room for strategic decision-making.

Enhancing Employee Productivity

Time spent filling out manual reports is time taken away from productive work. Automating expense claims allows employees to focus on their roles, knowing that the financial process behind the scenes is handled efficiently.

Better Policy Compliance

When policies are automated within a system, errors and non-compliance are significantly reduced. Employees know what is acceptable, managers have visibility, and finance teams receive consistent data for reporting.

Improved Financial Transparency

Having access to real-time data through expense manager online solutions provides greater transparency for decision-makers. Leaders can quickly spot spending patterns, address irregularities, and allocate resources more effectively to support business growth.

Cost Control and Savings

By centralising expense processes, businesses can monitor spending trends and identify opportunities to cut costs. This not only helps avoid overspending but also contributes to creating long-term savings strategies.

Streamlined Reporting and Analytics

Smart expense tools generate detailed reports and analytics that provide actionable insights. Finance leaders can use this data to forecast budgets accurately and plan for future organisational needs with clarity.

Conclusion

Modern organisations can no longer rely on outdated manual processes to manage expenses effectively. By embracing intelligent digital solutions, businesses can achieve greater efficiency, improve compliance, and control costs effortlessly. Tools that integrate automation, transparency, and real-time analytics ensure companies stay competitive while empowering employees with ease of use. Platforms like myBiz showcase how seamless financial management can truly become a reality for businesses today.